Tax Amnesty – Finance Bill 2023

Tax Amnesty – Finance Bill 2023

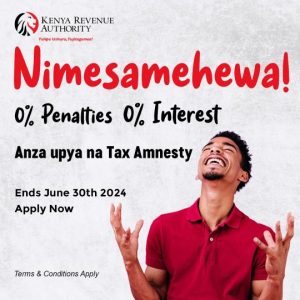

After the lifting all the conservatory orders standing in the way of the implementation of the Finance Act 2023, all that is stipulated in the bill is legally effective. Though the finance bill faced substantial disapproval, it has provided for techniques aimed at providing taxpayers relief. It is critical to note that the Finance Act issues a tax amnesty on interest and penalties on tax debt in the event the person had the principal tax due on 31 December 2022.

As a result, the treasury urged the National Assembly to issue an amendment of the Tax Procedure Act 2015, to give room for the one-year tax amnesty on interest and penalties on the accrued tax debts up to December 31, 2022. Thus, all taxpayers are encouraged to take advantage of the period to ensure that they have a clean tax ledger by heeding the call, paying the tax arrears.

The key objective of the tax amnesty is to enhance compliance with the tax man. The huge step to have the tax amnesty enhances the success of the Voluntary Tax Disclosure Program (STDP) which is currently underway and by March of 2023, the Kenya Revenue Authority (KRA) had collected Kshs. 9.3 billion as said by a tax expert at Cliffe Dekker Hofmeyr.

Implication of Tax Amnesty to Your Business

The tax amnesty provided by the finance bill of 2023 provides all taxpayers with an amazing opportunity to have a comprehensive review of their previous tax returns and make probably amendments and, or file any outstanding tax returns. Therefore, we strongly recommend taxpayers to begin reviewing their tax returns and ensure that they file for their tax obligations as soon as possible.

The general public should therefore understand that the tax amnesty provides a huge benefit by reducing their tax liabilities and issuing criminal immunity. Additionally, amnesties also provide the tax administration with benefits, especially in terms of the tax revenue generated and future compliance.

Furthermore, to ensure smooth operations and attainment of tax collection objective, the government has established codification of electronic tax invoice management system (TIMS) and the requirement that tax payers account for Withholding tax within 24 hours.

NOTE: The Finance Act provides for a tax amnesty on interest or penalties on unpaid principal tax up to December 31 2022 with a condition that such unpaid principal is paid by June 30, 2024. After this period, there will be no room for taxpayers to apply for waiver of penalties and interest arising from non-compliance and neither will the commissioner have such powers to grant waivers.

What Is the Difference Between Tax Amnesty and Waiver?

Tax amnesty is a periodic and designed for persons or activities with the objective of addressing a precise problem or to achieve a precise objective, for instance, to ensure collection of untaxed income. There is a guaranteed percentage of waiver of interest and penalty under tax amnesty, based on prescribed circumstances that present with every tax amnesty opportunity.

On the other hand, tax waiver is a provision under the Tax Procedures Act section 89(7) and Regulations 85 of the East African Community Customs Management Regulations (EACCMR) 2020 relating to waiver of Customs Warehouse Rent. A taxpayer can lodge an application for waiver of interest or penalty once they have paid the whole principal tax. Although the taxpayer has the chance to apply for a waiver, there is never a guarantee that their request will be granted.

Nevertheless, the law provides that a taxpayer to make an application to the KRA- Kenya Revenue Authority for an amnesty of penalties or interest on the unpaid tax and come up with a suitable payment plan in the event the taxpayer has not cleared their outstanding principal tax by 31 December 2022.

The Scope of Tax Amnesty:

- Tax amnesty only covers penalties or interest on unpaid principal accrued up until December 2022.

- A person has to do the following to be granted the tax amnesty:

- Officially applied for amnesty and clears all the outstanding principal taxes not later than 30 June 2024.

- Does not further incur tax debt

- Officially signs a commitment letter for a comprehensive plan for settling of all of the outstanding taxes that the person owes

- Submit all outstanding returns and correct any taxes that was disclosed incorrectly in the returns that was filed previously

With this in mind, it is vital to note that any amount of principal tax that remains unpaid on 30 June 2024 shall attract penalties and interest and there shall be no amnesty for such penalties and interest under the provision.

Moreover, it is important to note that the tax amnesty is not applicable to penalties on tax avoidance under section 85 of the Tax Procedures Act. Tax avoidance is a scheme, or transaction meant to avoid tax liability to pay tax under the law. And as such the penalty of such offences, tax avoidance, is to double the amount of the tax that a taxpayer would have been avoided.

How To Treat Erroneous Penalty and Interest In iTax Arising from Wrong Obligation.

The taxpayers have to present their application for removal of erroneous penalty and interest to the Debt Office in the respective TSO of the taxpayer. The officer will then examine the application and the presented evidence, and if all the requirements are met, the officer initiates a request for reversal of erroneous penalty and interest on iTax. All these is conducted in line with the guidelines provided in the procedure.

How Dennykins and Associates Can Help

Here at dennykinsassociates.com, we have a team of competent tax experts, dedicated to provide you with all tax solutions. As such, we have designed a comprehensive methodology and approach to help taxpayers identify errors in their past tax returns, if any.

Reach out to us via email, call, or visit our office for more guidance by tax experts. We strive to provide a solution to all your tax questions and ensure you conduct smooth business operations.